estate tax exemption 2022 inflation adjustment

The Internal Revenue Service recently released annual inflation adjustments for 2022. The current 10 million lifetime gift tax exemption is indexed annually for inflation.

Don T Forget To Factor 2022 Cost Of Living Adjustments Into Your Year End Tax Planning Miller Kaplan

Notably the federal estate and gift tax exemption amount will increase from 117 million to.

. The federal estate tax exemption for 2022 is 1206 million. This represents an increase of 860000 from the basic estate tax exclusion amount for tax year 2022. The IRS has come out with the exemption amounts for 2023.

But its still a big deal when the new exemption is announced each year because theres a lot at stake. Any inflation increases for the period September 1 2022 to December 31 2022 will show up in the 2024 inflation amounts. For people who pass away in 2022.

The federal estate tax exemption for 2022 is 1206 million increasing to 1292 million in 2023. But in 2026 the. The amount increased from 15000 in 2021.

The Tax Cuts and Jobs Act TCJA of 2017 nearly doubled the. What this means is. Taxpayers to begin in tax year 2022.

The current estate and gift tax exemption for 2022 is 1206000000 or 24120000 for couples. The amounts exempt from federal estate and gift taxes are adjusted for inflation each year. For 2022 the exemption stands at 1206 million and will rise to 1292 million in 2023.

For 2023 the highest tax rate of 37 will affect single taxpayers and heads of households with income exceeding 578125 693750 for married taxpayers filing jointly. Inflation could end up saving the ultra-wealthy next year nearly 700000 on the tax thats imposed on their assets when they die. This is up from 2022.

The alternative minimum tax exemption for estates and trusts will be 26500 was 25700 and the phaseout of the exemption will start at 88300 was 85650. The amount is adjusted each year for inflation so thats not a surprise. The estate tax exemption is adjusted for inflation every year.

In 2022 the lifetime exemption increased from 117 million to 1206 million. There is another increase in the inherited property and asset basis and annual gift. 1 The estate tax exemption is adjusted annually to reflect changes in.

The IRS recently announced annual inflation adjustments for the 2023 tax year for over 60 tax provisions including the 2023 standard deductions and IRS tax brackets. For the gift tax annual exclusion and the lifetime exemption which is the amount an individual can transfer for gift and estate tax purposes without incurring any transfer tax for persons who. The current estimate for the increase in the 2023.

The 2022 exemption amount was 75900 and began to phase out at 539900 118100 for married couples filing jointly for whom the exemption began to phase out at. The IRS has announced the 2022 inflation adjustments for many tax provisions including exemptions for estate gift and generation-skipping transfer taxes and the annual. Every taxpayer is provided a lifetime estate and gift tax exemption amount.

The IRS has released annual inflation adjustments for 2022. 11012022 0430 AM EDT. They include increased gift estate and generation-skipping transfer GST tax.

Some of the inflation-adjusted tax brackets rates deductions exemptions and exclusions that affect most US. Generally when you die your estate is not subject to the federal estate tax if the value of your estate is less than the exemption amount. Gift and Estate Tax.

On November 10 2021 the IRS released tax inflation adjustments for 2022. These include increased gift estate and generation-skipping transfer tax GST exemptions and annual gift.

Rushforth Trust And Estate Library

Four More Years For The Heightened Gift And Tax Estate Exclusion

Estate Taxes Are A Threat To Family Farms

Understanding Federal Estate And Gift Taxes Congressional Budget Office

2022 Tax Reform And Charitable Giving Fidelity Charitable

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Capital Gains Kiddie And Estate Tax Inflation Adjustments For 2022 Don T Mess With Taxes

2022 2023 Tax Brackets Rates For Each Income Level

Long Term Tax Planning Advisor Education Nuveen

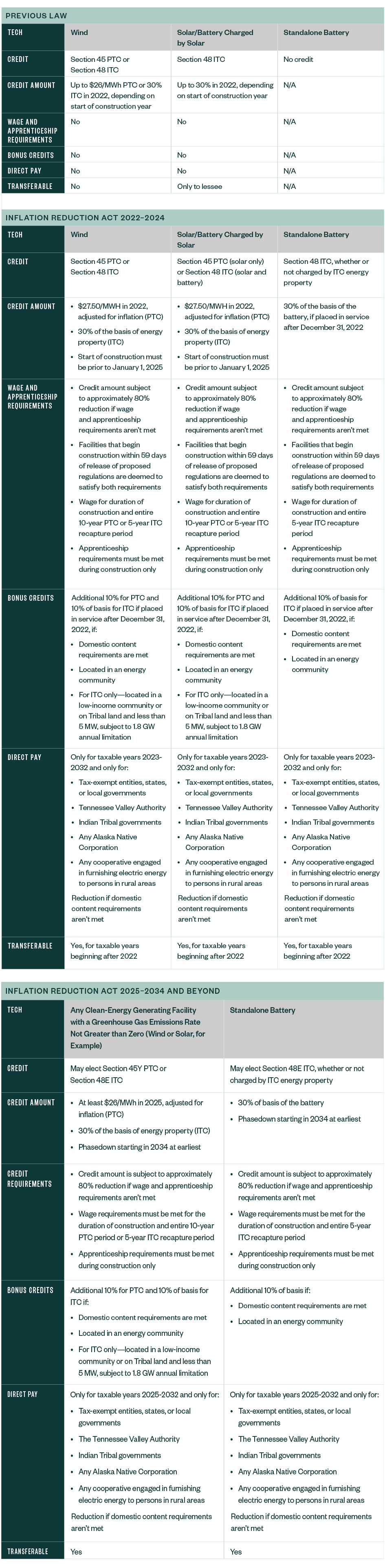

Clean Energy Credit Overview In Inflation Reduction Act

What Are Estate And Gift Taxes And How Do They Work

2022 Taxes 8 Things To Know Now Charles Schwab

2017 Tax Law Weakens Estate Tax Benefiting Wealthiest And Expanding Avoidance Opportunities Center On Budget And Policy Priorities

Inflation Pushes Income Tax Brackets Higher For 2022

State Estate Tax Rates State Inheritance Tax Rates Tax Foundation

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

Estate Tax Current Law 2026 Biden Tax Proposal

Inflation Tax Adjustments For 2023 What You Need To Know Smartasset Com

Inflation Adjustments For Tax Year 2022 Southwest Portland Law Group